Mortgage Broker in Warman: Your Guide to Securing the Best Mortgage Solutions

Mortgage Refinance | Mortgage Renewals | Private Mortgage Lending

With the combination of her experience and education, underscored by integrity, Maria Titarenko is known for delivering honest, unbiased mortgage advice. Clients appreciate that Maria’s commitment is to them, not the lenders.

Why Choose Maria Titarenko as Your Mortgage Broker in Warman

Maria Titarenko is an experienced mortgage broker offering expert mortgage services in Warman. Her personalized approach and deep industry knowledge make her an invaluable partner in navigating the complexities of the mortgage market.

Personalized Solutions for Every Client

Maria offers tailored mortgage solutions that meet your unique needs. She takes the time to understand your financial situation, helping you find the right mortgage product, whether you're a first-time homebuyer or refinancing your current home.

The Role of Mortgage Brokers in Home Financing

With extensive knowledge of the local mortgage landscape, Maria provides strategic advice to help you make informed decisions. Her expertise ensures that you receive competitive rates and the most favorable mortgage terms available.

The Importance of Mortgage Services in Warman

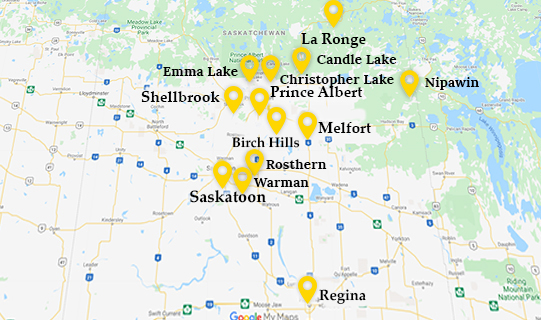

Warman, Saskatchewan, is an increasingly popular choice for homebuyers and investors. As the community grows, so does the need for professional mortgage services in Warman. The complexity of mortgage options, fluctuating interest rates, and understanding the right loan terms can be overwhelming without expert guidance. Whether you're a first-time buyer or looking to refinance, knowing how to navigate the mortgage landscape is essential for securing the best deal.

What Mortgage Services Are Available in Warman?

Mortgage services in Warman offer a wide variety of options to suit different financial situations. From first-time homebuyers to experienced investors, you can find solutions that meet your needs. These services include mortgage pre-approval, refinancing, mortgage renewals, and advice on choosing the right loan type. A professional mortgage broker can help simplify the process and ensure that you receive the most competitive rates.

Why Personalized Mortgage Solutions Matter

Each homebuyer’s situation is unique. A personalized approach ensures that your mortgage is tailored to your specific financial goals. With the right advice, you can choose the best mortgage product for your needs, helping you save money and time in the long run.

Contact our mortgage experts today to learn more about the mortgage services available in Warman and how we can help you secure the best deal for your home purchase or refinance.

Common Mortgage Challenges in Warman

While securing a mortgage can be an exciting step toward homeownership, many challenges arise during the process. Homebuyers in Warman often face difficulties when dealing with the intricacies of the mortgage process. It’s important to understand the most common challenges and how you can overcome them.

Navigating the Different Mortgage Products

One of the biggest challenges is understanding the variety of mortgage products available. Whether you’re considering a fixed-rate or adjustable-rate mortgage, knowing the benefits and drawbacks of each option is crucial. A mortgage broker in Warman can guide you through these options and help you select the one that suits your financial situation best.

Interest Rate Fluctuations and Their Impact

Interest rates play a critical role in determining your monthly payments and the total cost of your mortgage. These rates can fluctuate based on the economy, making it challenging to predict your mortgage expenses. Working with a mortgage broker in Warman allows you to lock in the best rates or explore other mortgage products that suit your needs during rate changes.

Ready to navigate these mortgage challenges with ease? Contact our team of experienced mortgage brokers in Warman to get the best guidance and advice for your unique situation.

The Benefits of Working with a Mortgage Broker in Warman

A mortgage broker can be an invaluable asset in securing the best mortgage deal for your home. Their role in simplifying the mortgage process cannot be overstated, offering personalized advice and market insights that help you make informed decisions.

Personalized Mortgage Advice and Tailored Solutions

Mortgage brokers in Warman take the time to understand your specific needs, offering advice that aligns with your financial situation. Whether you're a first-time buyer or refinancing, a broker ensures you’re equipped with the knowledge to make the best decisions for your future.

Access to a Wide Range of Lenders and Mortgage Products

Mortgage brokers have access to multiple lenders and mortgage products, which increases your chances of finding the best possible deal. Instead of being limited to one bank’s offerings, a broker can shop around and find options that best fit your needs, saving you both time and money.

Experience the benefits of working with a mortgage broker in Warman today. Reach out to our team and let us help you secure the best mortgage for your home purchase or refinance.

Overcoming Mortgage Obstacles in Warman: Key Strategies

While the mortgage process can seem overwhelming, there are several strategies that can help make the journey smoother. From improving your credit score to seeking professional guidance, these steps will ensure you are well-prepared for the mortgage process.

Improve Your Financial Profile for Better Mortgage Rates

Your credit score plays a major role in determining your eligibility for a mortgage and the rates you'll receive. Improving your credit score by paying down debt and ensuring timely payments can increase your chances of securing a favorable mortgage rate.

Stay Informed About the Market and Interest Rates

The mortgage market can fluctuate, and staying informed about interest rates and economic conditions will help you make timely decisions. Mortgage brokers in Warman are a great resource for keeping up-to-date with changes that might affect your mortgage.

Need help improving your financial profile or understanding current market trends? Contact our team to discuss strategies that will help you secure the best mortgage deal in Warman.

FAQs

What are the best mortgage services in Warman for first-time buyers?

First-time buyers in Warman can benefit from mortgage services that include personalized advice and access to multiple lenders. A mortgage broker can guide you through the best options for your financial situation.

How does my credit score affect my mortgage eligibility in Warman?

Your credit score is a key factor in determining your mortgage eligibility and interest rate. A higher score can help you secure better terms, while a lower score may result in higher rates.

Can a mortgage broker in Warman help me refinance my home?

Yes, mortgage brokers in Warman can help you refinance by offering tailored advice and finding the best refinancing options based on your financial goals.

How do interest rates impact my mortgage in Warman?

Interest rates significantly affect your monthly payments and the total cost of your mortgage. Fluctuating rates may impact your loan, so it’s important to work with a broker who can help you lock in favorable rates.

Why should I work with a mortgage broker in Warman?

A mortgage broker in Warman provides expert advice, access to a wide range of lenders, and personalized solutions that can help you secure the best mortgage terms for your home purchase or refinance.